Start

2023

The first half year in brief

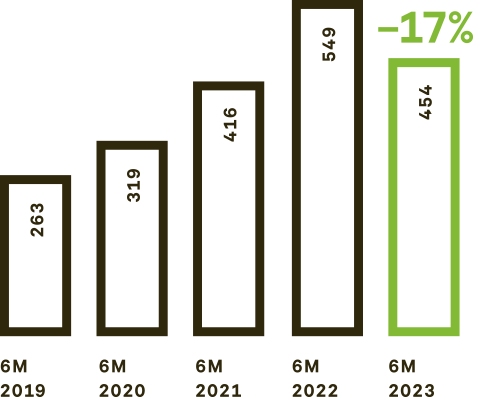

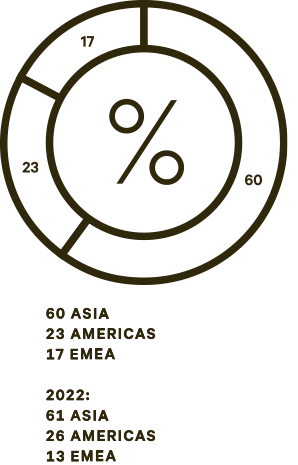

The slowdown in semiconductor equipment spending shows expected impact on orders, sales, and profitability. As VAT believes that the market might have bottomed and that demand is set to gradually improve over remainder of 2023, it remains ready for higher volumes and returning to growth in 2024.